A Biased View of Custom Private Equity Asset Managers

Wiki Article

Not known Details About Custom Private Equity Asset Managers

(PE): investing in companies that are not publicly traded. Approximately $11 (https://www.merchantcircle.com/blogs/custom-private-equity-asset-managers-abilene-tx/2023/12/The-Power-of-a-Private-Equity-Firm-in-Texas-and-Asset-Management-Group/2608142). There might be a few things you don't understand about the market.

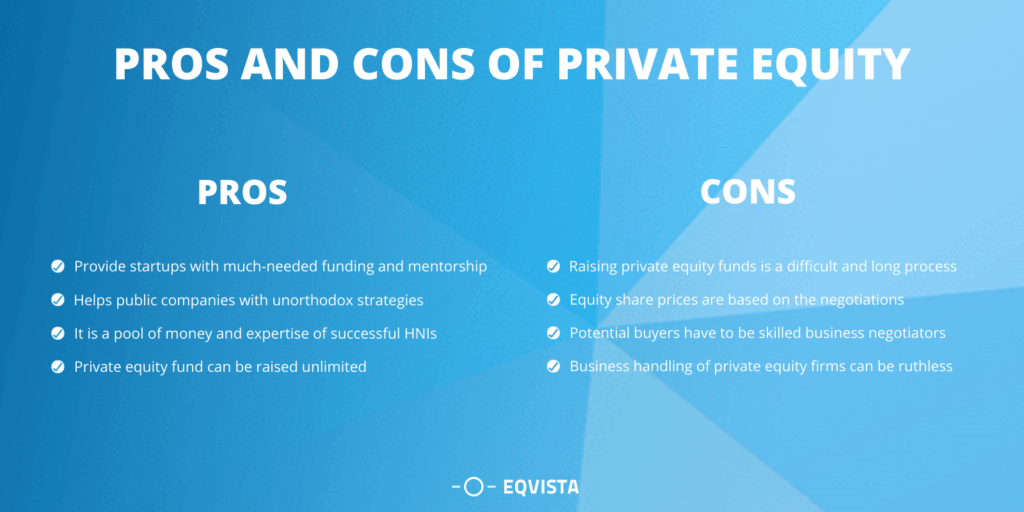

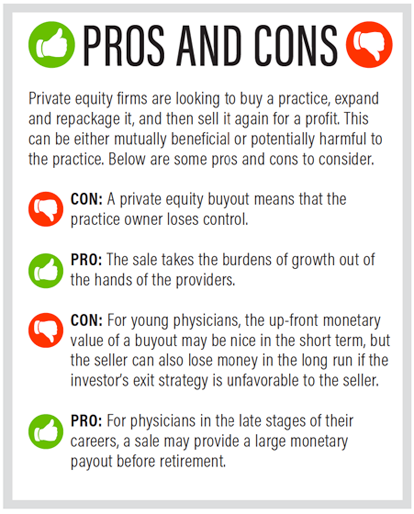

Companions at PE companies raise funds and manage the cash to generate beneficial returns for investors, typically with an investment perspective of between 4 and 7 years. Exclusive equity firms have a series of investment preferences. Some are strict investors or easy investors wholly depending on administration to expand the business and produce returns.

Because the most effective gravitate toward the larger deals, the center market is a considerably underserved market. There are a lot more vendors than there are extremely experienced and well-positioned finance experts with considerable customer networks and sources to manage a bargain. The returns of private equity are generally seen after a few years.

Some Known Questions About Custom Private Equity Asset Managers.

Traveling below the radar of large multinational corporations, a number of these small companies typically provide higher-quality customer support and/or specific niche products and services that are not being offered by the huge empires (https://www.awwwards.com/cpequityamtx/). Such advantages attract the interest of exclusive equity firms, as they possess the understandings and wise to exploit such chances and take the company to the following level

see here nowPrivate equity investors must have dependable, capable, and reputable monitoring in place. A lot of managers at portfolio companies are given equity and benefit payment structures that award them for hitting their financial targets. Such alignment of goals is commonly needed before a bargain gets done. Exclusive equity opportunities are usually out of reach for people that can not invest countless bucks, yet they should not be.

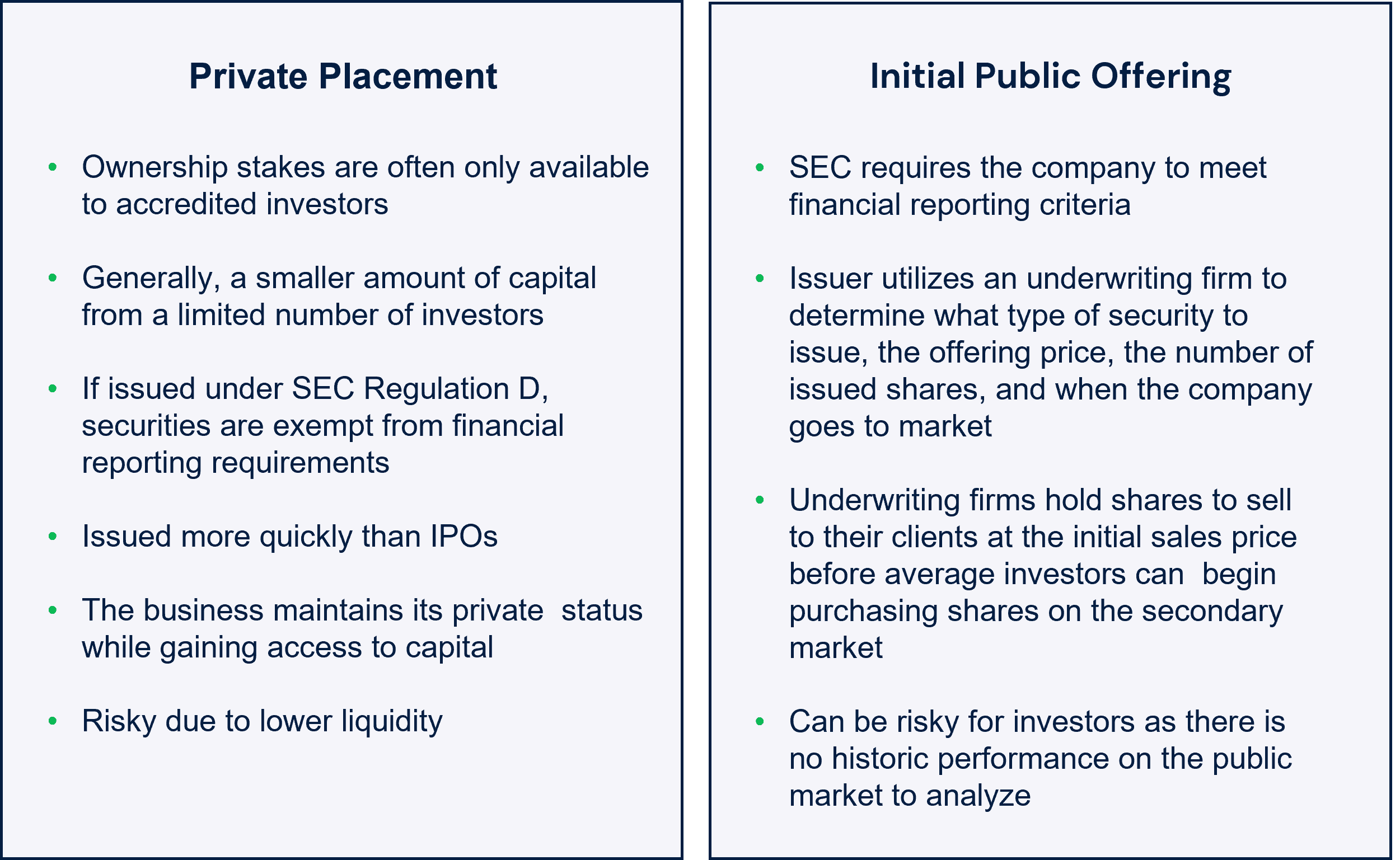

There are regulations, such as limitations on the aggregate amount of cash and on the number of non-accredited capitalists (Asset Management Group in Texas).

An Unbiased View of Custom Private Equity Asset Managers

One more drawback is the absence of liquidity; when in a private equity deal, it is hard to leave or offer. There is an absence of flexibility. Exclusive equity likewise includes high charges. With funds under management currently in the trillions, personal equity companies have become eye-catching investment vehicles for affluent individuals and institutions.

For years, the features of personal equity have actually made the property course an attractive proposition for those that can take part. Currently that access to exclusive equity is opening as much as even more private financiers, the untapped capacity is becoming a reality. The question to take into consideration is: why should you invest? We'll start with the primary debates for buying exclusive equity: How and why personal equity returns have actually historically been more than other properties on a variety of degrees, Just how including private equity in a portfolio impacts the risk-return account, by aiding to diversify against market and intermittent risk, Then, we will lay out some key factors to consider and threats for personal equity capitalists.

When it concerns presenting a brand-new property into a portfolio, one of the most basic consideration is the risk-return profile of that asset. Historically, exclusive equity has actually shown returns comparable to that of Emerging Market Equities and higher than all various other typical property classes. Its fairly low volatility paired with its high returns produces an engaging risk-return profile.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

In reality, private equity fund quartiles have the largest variety of returns throughout all alternate asset courses - as you can see listed below. Methodology: Inner price of return (IRR) spreads computed for funds within vintage years individually and then balanced out. Median IRR was calculated bytaking the standard of the average IRR for funds within each vintage year.

The impact of including personal equity right into a portfolio is - as constantly - dependent on the profile itself. A Pantheon research study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best private equity firms have access to an even larger swimming pool of unknown opportunities that do not deal with the exact same analysis, along with the resources to do due diligence on them and determine which are worth buying (Private Equity Platform Investment). Spending at the very beginning implies greater danger, however for the companies that do be successful, the fund take advantage of higher returns

The 6-Minute Rule for Custom Private Equity Asset Managers

Both public and private equity fund managers devote to investing a percentage of the fund however there continues to be a well-trodden issue with aligning rate of interests for public equity fund administration: the 'principal-agent trouble'. When a capitalist (the 'principal') hires a public fund manager to take control of their funding (as an 'agent') they hand over control to the supervisor while retaining ownership of the possessions.

In the case of private equity, the General Partner doesn't simply make a monitoring fee. Personal equity funds also alleviate one more form of principal-agent trouble.

A public equity capitalist inevitably wants one thing - for the monitoring to boost the stock rate and/or pay rewards. The financier has little to no control over the decision. We revealed above the amount of personal equity methods - particularly bulk acquistions - take control of the running of the firm, guaranteeing that the long-term worth of the firm comes first, raising the return on financial investment over the life of the fund.

Report this wiki page